Diamond Price Calculator

Total Landed Cost

Looking for the cheapest country to buy diamonds? Prices can swing wildly depending on taxes, import duties, and how close you are to the major cutting hubs. Below we break down where you’ll get the lowest price per carat, what hidden costs to watch out for, and how to protect yourself when buying abroad.

Key Takeaways

- Dubai (UAE) and India consistently offer the lowest total cost per carat after taxes.

- VAT and import duties can add 5‑25% to the sticker price; factor them in before you book a trip.

- Always ask for a reputable grading certificate (GIA, IGI, HRD) to avoid fake stones.

- Use a secure payment method and get a written invoice that details the 4Cs.

- Follow a simple checklist to keep the purchase safe and hassle‑free.

How Diamond Pricing Really Works

Diamonds are carbon crystals graded by the 4Cs-carat, cut, color, and clarity-that drive their market value. The base price you see on a merchant’s sheet is just the raw per‑carat cost for a stone that matches those attributes. From there, three big cost layers appear:

- Wholesale margin: Cutting, polishing, and dealer mark‑ups. Major hubs like Antwerp, Dubai, and Surat keep these margins thin because of high volume.

- Taxes & duties: Value‑added tax (VAT) or goods‑and‑services tax (GST) can range from 0% (UAE) to 20% (EU). Some countries also charge import duties on stones brought across the border.

- Certification & paperwork: A GIA or IGI certificate adds credibility but also a small fee (usually $100‑$200).

When you add these layers together, the country with the lowest headline price isn’t always the cheapest overall. That’s why we look at the total landed cost per carat.

Top Countries Offering the Lowest Total Cost

Here are the markets that consistently beat others in total landed cost per carat for a 1‑carat, VS2‑SI1, round‑cut diamond (the most common benchmark).

United Arab Emirates (Dubai) is a tax‑free trading hub where many wholesalers quote prices without VAT. Average price: $4,500/carat. No import duty for personal use, and the city’s Diamond Exchange offers certified stones from reputable cutters.

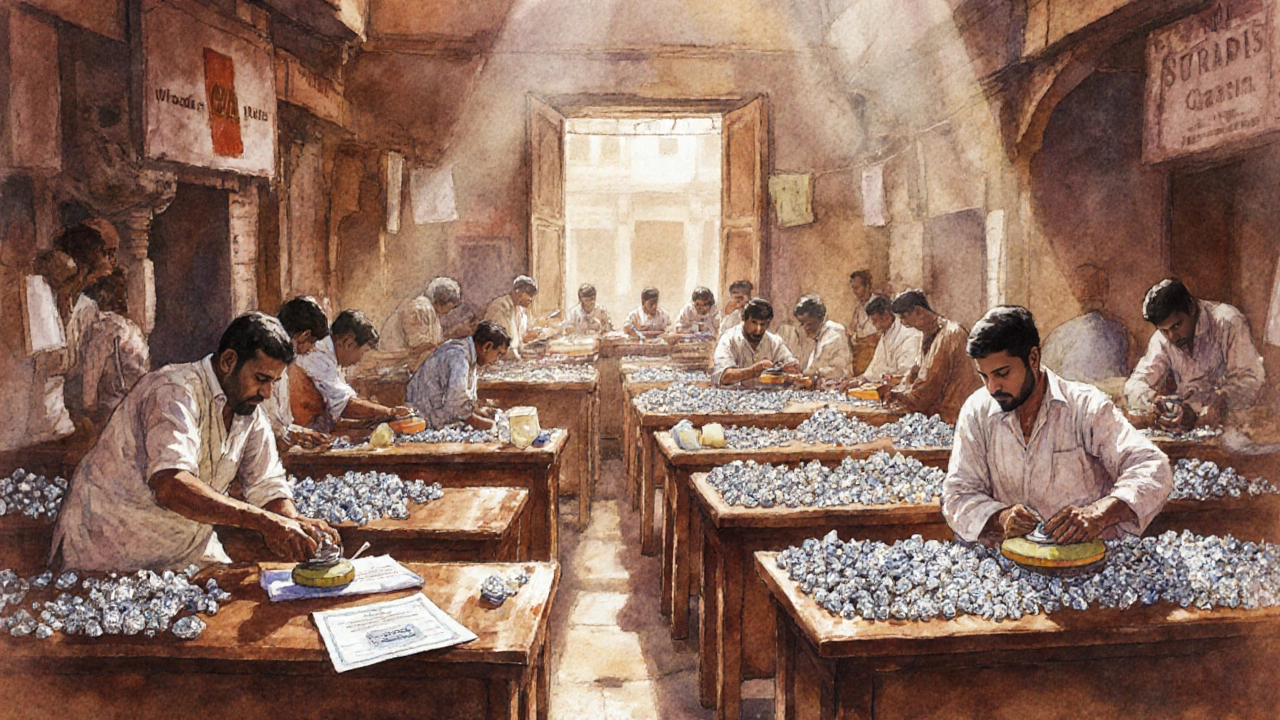

India (Surat) hosts the world’s largest polishing centre, giving it unrivaled wholesale pricing. Average price: $4,600/carat. GST is 5% for personal purchases, and many dealers waive the fee for export‑focused buyers.

Hong Kong offers a zero‑VAT environment and a strong legal framework for gemstone trade. Average price: $4,750/carat. No import duty, but a modest 0% sales tax means the headline price stays low.

Belgium (Antwerp) hosts Europe’s premier diamond market with transparent wholesale pricing. Average price: $4,800/carat. VAT is 21% for non‑EU residents, but many dealers provide a VAT‑refund on export.

Singapore is an emerging Asian hub with low import duties and a strong regulatory regime. Average price: $4,850/carat. GST at 7% applies, but refunds are possible for export purchases.

Botswana produces raw diamonds locally, allowing buyers to purchase at mine‑gate prices. Average price: $5,100/carat. No VAT; however, logistic costs can raise the final amount.

Rwanda has a growing diamond‑sorting industry that offers competitive pricing for small‑scale buyers. Average price: $5,200/carat. Minimal taxes, but limited certification services mean you may need to arrange independent grading.

Price Comparison of Cheapest Diamond Markets

| Country | Base price per carat | VAT / GST | Import duty | Total landed cost |

|---|---|---|---|---|

| United Arab Emirates (Dubai) | $4,500 | 0% | 0% | $4,500 |

| India (Surat) | $4,600 | 5% GST | 0% | $4,830 |

| Hong Kong | $4,750 | 0% | 0% | $4,750 |

| Belgium (Antwerp) | $4,800 | 21% VAT (refundable) | 0% | ~$5,800 (net after refund) |

| Singapore | $4,850 | 7% GST | 0% | $5,190 |

| Botswana | $5,100 | 0% | 0% | $5,100 + logistics |

| Rwanda | $5,200 | 0% | 0% | $5,200 + certification |

Practical Tips for Buying Diamonds Abroad

- : Request a GIA, IGI, or HRD report. If the seller can’t provide one, walk away.

- : Look for members of the local diamond bourse, such as the Dubai Diamond Exchange or the Antwerp World Diamond Centre.

- : Credit cards or escrow services give you a paper trail and some buyer protection.

- : Use a 10× loupe, check for inclusions, and compare the cut grade against the certificate.

- : Most countries allow a personal exemption of $10,000‑$20,000 for jewelry. Declare the purchase and keep the invoice to avoid penalties.

- : Many dealers offer insured courier service from the marketplace to your home. Ask for a full insurance value covering loss or damage.

Checklist Before You Commit

- Confirm the 4Cs match the certificate.

- Calculate total landed cost (price + VAT/GST + any duty + shipping insurance).

- Verify the dealer’s membership in a recognized diamond bourse.

- Ask for a return policy (at least 7 days) and a proof‑of‑origin document.

- Arrange a secure payment method and keep all receipts.

- Check your home country’s customs exemption limits and prepare documentation.

Frequently Asked Questions

Is it legal to bring a diamond purchased abroad into the UK?

Yes, as long as the stone’s value is below the personal allowance (£10,000 as of 2025) and you declare it if you exceed that threshold. Keep the invoice and certificate; customs may ask to see them.

Do I need to pay VAT when buying in Dubai?

Dubai imposes no VAT on diamond sales for personal buyers, which is why it consistently ranks as the cheapest market.

How can I verify a diamond’s authenticity on the spot?

Ask to see the grading certificate, then examine the stone with a 10× loupe. Match the certificate’s plot diagram to the stone’s visible inclusions. If possible, use a portable spectroscope to check for synthetic signatures.

What are the risks of buying diamonds online from overseas?

Risks include counterfeit stones, inaccurate grading, and non‑delivery. Mitigate by buying only from bourse‑registered sellers, using escrow, and demanding a certified return policy.

Can I get a refund on VAT paid in Belgium?

Non‑EU residents can claim a VAT refund on exported diamonds. You’ll need the original invoice, a customs export form, and to submit the paperwork within 90 days of purchase.